how does doordash report to irs

Doordash will send you a 1099-NEC form to report income you made working with the company. A 1099 form differs from a W-2 which is the standard form issued to employees.

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

However as of June 15 2021 the Payable DoorDash relationship ended when Payable announced that it needed to shut down its business.

. At the end of every quarter add up your income for the quarter and pay at least 25 of that online to the govt. DoorDash does not automatically withhold taxes. Form 1099-NEC reports income you received directly from DoorDash ex.

These items can be reported on Schedule C. Because drivers will owe taxes from their profits from dashing a smart move would be to set aside about 30 percent of earnings in a bank account to prepare for paying taxes. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation.

Regardless of whether Doordash shares your income directly it will certainly be reported to the IRS eventually and your unemployment office will find out. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. People are making this way more complicated than it is.

It will look something like this. Stripe also sends 1099-Ks for other companies or payments but the way theyre set up with DoorDash means DoorDash work will go on a 1099-NEC for DoorDash. Typically you will receive your 1099 form before January 31 2022.

It doesnt matter in what format you have it written a notebook a log sheet anything is fine. You will calculate your taxes owed and pay the IRS yourself. If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe.

If you get the wrong information start with double checking your numbers. What are red flags to get audited. Does Doordash report to IRS.

When that happens Doordash is telling the IRS you made more than you did. Log into your checking account every pay day and put at least 25 of your dd earnings in savings. This article will explain how Dashers get their 1099 tax form from DoorDash and what you need to do to file your taxes correctly.

You do not get quarterly earnings reports from dd. Per IRS guidelines Gross Volume processed via the TPSO which in DoorDashs case is the Subtotal and Tax on orders processed. Does DoorDash Report to the IRS.

What is reported on the 1099-K. Theyve used Payable in the past In early January expect an email inviting you to set up a Stripe Express Account. In this rate all itemized expenses based on the economic environment of each year are accounted for.

We have a winner here. However according to DoorDash. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year.

DoorDash doesnt keep track of your mileage as a delivery driver so you cant just login to your Dasher app and get a tax-ready print out of all the mileage you drive for DoorDash. This isnt always the case. DoorDash uses Stripe to process their payments and tax returns.

If youre a Dasher youll need this form to file your taxes. Most DoorDash drivers use the Standard Mileage Rate method. How does Doordash report to IRS.

Internal Revenue Service IRS and if required state tax departments. Its a straight 153 on every dollar you earn. DoorDash is an independent contractor and doesnt automatically withhold federal or state income taxes.

How do I report DoorDash income. The forms are filed with the US. DoorDash used Payable to help its food delivery drivers with their taxes in the past.

Go through all your bank records and add up all deposits. Keep an eye out for this email and make sure it doesnt go to spam youll. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

If youre purely dashing as a side hustle you might only have to pay taxes one a year. Literally noone has attempted to answer my question yet. Form 1099-NEC reports income you received directly from DoorDash ex.

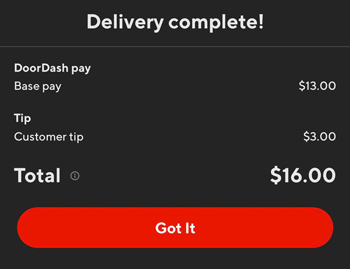

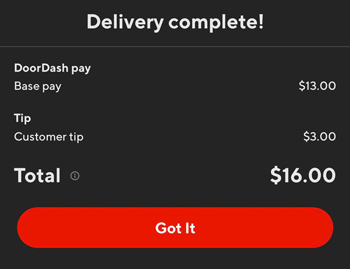

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. DoorDash does not provide a breakdown of your total earnings between base pay tips pay boosts milestones etc. DoorDash sends their 1099s through Stripe.

DoorDash 1099s Each year tax season kicks off with tax forms that show all the important information from the previous year. Therefore the standard rate accounts for cost of gas depreciation etc. How often does DoorDash report to IRS.

Incentive payments and driver referral payments. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

Form 1099-NEC is new. There are no tax deductions or any of that to make it complicated. This is the reported income a Dasher will use to file their taxes.

Since dashers are treated as business owners and employees they have taxes payable whether they are full-time dashers or drive for DoorDash on the side. All you legally have to have is a written log of miles driven. Annually the IRS annually specifies a per mile rate for this method.

Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC. As such it looks a little different. The most important box on this form that youll need to use is Box 7 Nonemployee Compensation This reports your total earnings from Doordash for last year.

How much taxes do you pay on DoorDash. Does DoorDash report to IRS. If you expect to owe the IRS 1000 or more in taxes then you should file estimated quarterly taxes.

That leaves you either having to pay more than you should in taxes or leaves you open to the IRS coming after you for under-reporting taxes. An independent contractor cant deduct mileage and gasoline at the same time. Instead youll likely have to file taxes four times a year or quarterly.

No tiers or tax brackets. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly. Incentive payments and driver referral payments.

Whether youre in the US or in Canada you may be able to deduct expenses from your earnings and only pay taxes on the. If you overpaid at the end of the year you will get some money. Therefore the safe thing to do is always to follow the rules and report any income that you receive to avoid accusations of fraud repayments and penalties.

Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs.

How Does The Doordash 1099 Thing With Stripe Work 2022

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Mileage Report What S Required How Falcon Expenses Can Help Mileage Tracking Mileage Tracking App

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Does Doordash Do Taxes Taxestalk Net

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

A Beginner S Guide To Filing Doordash Taxes 4 Steps

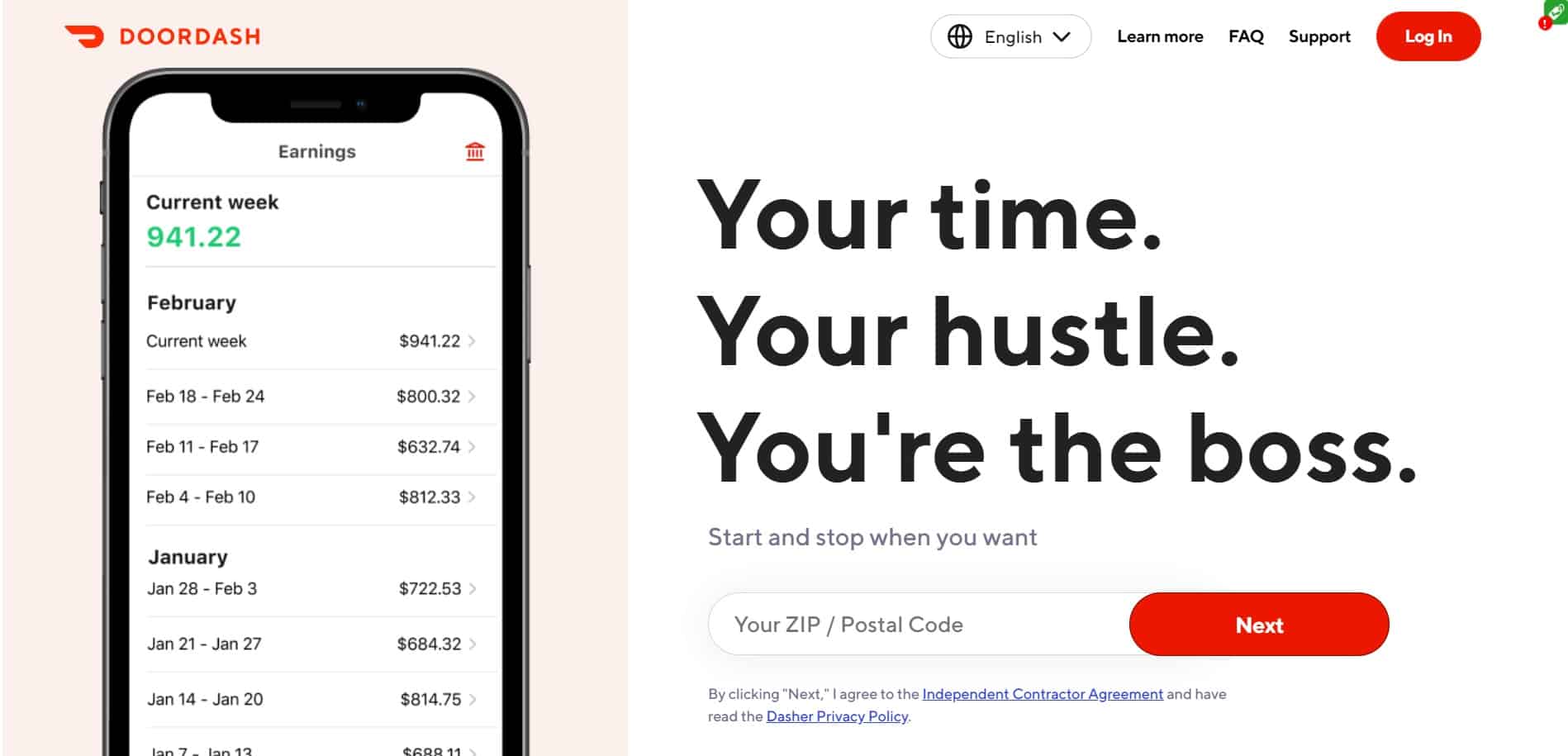

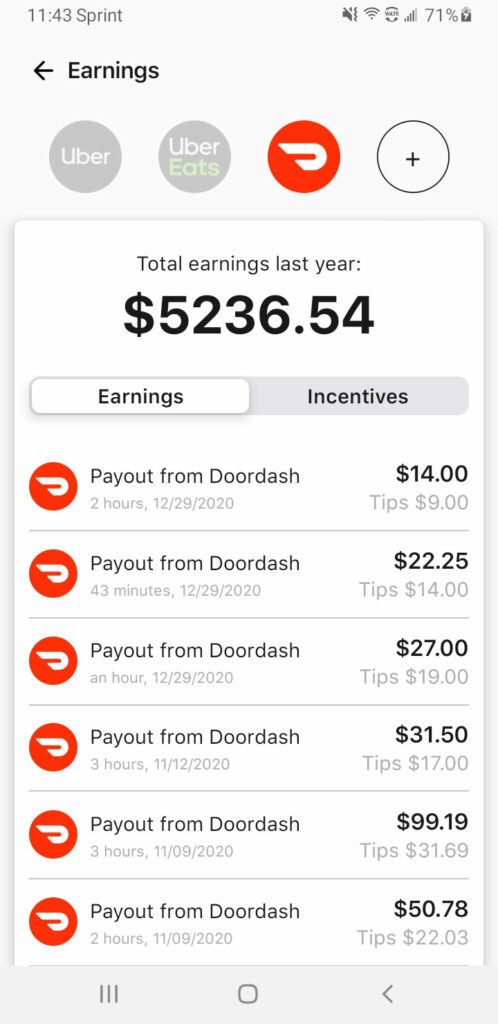

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

How Much Did I Earn On Doordash Entrecourier

8 Essential Things You Should Know About Doordash 1099

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

How To File Your Taxes For Door Dash Drivers In 2022 Mileage Tracker Tax Deductions Tax

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support